What's in a Day? Navigating a move to T+1 Settlement

August 2021

Straight To The Point

Earlier this year, the Depository Trust & Clearing Corporation (DTCC) proposed a plan for shortening the settlement cycle for U.S. equities from two business days after the trade is executed (T+2) to one business day (T+1).1 Joining DTCC in support of this effort are the Investment Company Institute (ICI) and the Securities Industry and Financial Markets Association (SIFMA). Under the proposed roadmap, the transition to T+1 would occur by 2023.2

The goal of reducing the time between trade and settlement is to reduce risk and improve capital efficiency while maintaining the benefits of the current market infrastructure – in particular, preserving the netting function currently performed by the National Securities Clearing Corporation (NSCC). DTCC has been working to improve settlement efficiencies for some time through its Integrated Settlement model,3 and this effort is part of a trend that began with the move from T+5 to T+3 in the early 1990s. The most recent change to the settlement cycle was the 2017 migration from T+3 to T+2.

The goal of this Point of View is to offer a high-level perspective on the types of operational updates or transition risks that market participations may need to manage. A full background of this initiative or discussion of applicable regulations is beyond the scope of this paper.

Background, Scope & Timing

Background

The “regular way” transaction settlement standard governs when securities and cash must be delivered to satisfy a trade. In 1993, the SEC updated the standard settlement cycle from T+5 to T+3. In 2017, the settlement cycle was further shortened to the current T+2. The primary goal of these updates and the proposed migration to T+1 is to reduce risk in the system by reducing the amount of cash exposed to market or counterparty risk at any given time. Market liquidity should also benefit as traders gain earlier access to securities and cash.

During the period between the confirmation and settlement of a trade, cash and securities must be identified, secured, and delivered – either to the ultimate buyer/seller or to a central counterparty (CCP). The role of a CCP, such as DTC and NSCC, is to act as the buyer for every seller and the seller for every buyer. In doing so, a CCP removes counterparty risk from the transaction process – specifically, the risk that the counterparty fails to deliver the cash or securities promised. Under this model, each additional day between trade and settlement dates increases the risk that a counterparty fails to fulfill its obligations. CCPs compensate for this risk by requiring margin on trades pending settlement.

While time creates risk in this model, time also allows for the CCP to “net” trades – balancing out shorts and longs to a single, netted position for each counterparty. This reduces the amount of cash and securities that change hands.4 Netting also allows market participants to mitigate their funding needs by offsetting transactions, providing additional risk mitigation to market participants.

This process and its mechanics were subject to public scrutiny during the “meme stock” trading activity in early 2021. Retail brokerage Robinhood blamed its suspension of GameStop purchases on increased capital requirements driven in part by “unnecessarily long” settlement cycle.5

Scope

The DTCC press release announcing the roadmap to T+1 refers to “U.S. equities” as the prime target of the initiative.6 However, SIFMA has subsequently published a preliminary list of products that are in-scope and which includes corporate and municipal bonds, agency securities, mutual funds, and real estate investment trusts, to name but a few.7 Changes to the “regular way” settlement process impact rules overseen by the Securities and Exchange Commission (SEC), Financial Industry Regulatory Authority (FINRA), Municipal Securities Rulemaking Board (MSRB), Office of the Comptroller of the Currency (OCC), Federal Deposit Insurance Corporation (FDIC), New York Stock Exchange and NASDAQ. Nearly all the impacted rules specify the number of days in the settlement cycle, meaning they will need to be updated to reflect the change. Some rules, such as OCC, FDIC and Federal Reserve regulations, incorporate by reference the FINRA and SEC rules and thereforemay self-execute the update to T+1.8

Timing

For the standardization of T+1 to be achievable, the industry will need to align9 and rules related to “regular way” settlement will need to be updated by the SEC and other regulators and oversight bodies. Based on the recent experience of migrating from T+3 to T+2, the rulemaking process for the SEC alone will take about one year from proposed rule to full compliance: 10

- T+2 Proposed Rule - September 28, 2016

- T+2 Final Rule - March 22, 2017

- Final Rule effective date - May 30, 2017

- Compliance date - September 5, 2017

Based on this experience, the full process of industry adoption will take roughly two years. This includes approximately six months of time developing and aligning implementation plans, and about 18 months of time implementing and testing the required systems and workflow updates, with parallel workstreams related to industry engagement.

The initial DTCC roadmap indicated a target of early 2023 for the market to align on the new T+1 settlement standard.11 However, a subsequent update published on SIFMA’s website in May 2021 indicates that the detailed roadmap for industry implementation was expected by the end of Q3 2021.12 This suggests that the earliest implementation target may now be the end of 2023 or later. With this in mind, and considering the two-year development and testing cycle, market participants should have their teams ready to define their project plans and scopes of work in Q4 2021. Market participants should also engage in industry working groups if they have not already. Lastly, observers should expect proposed rulemakings to begin sometime in 2022 for the proposed timeline to be achieved.

Transition – Areas of Focus

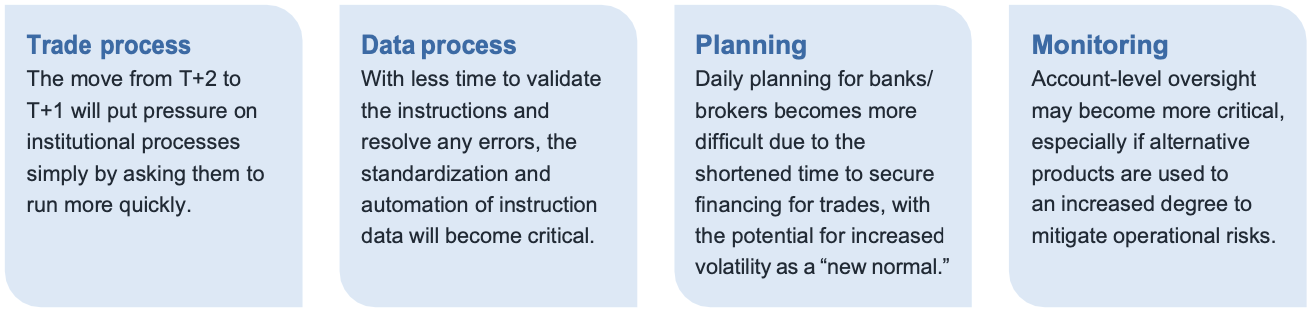

Given the recent migration from T+3 to T+2 and the consideration given then to a move to T+1, it is unlikely that this proposed update will be seriously disruptive from a technological standpoint. Indeed, NSCC and the Depository Trust Company already support T+1 and T+0 activity.13 However, market participants will need to carefully navigate the sheer volume of work and breadth of impacted parties as they reduce by half the time allowed to settle trades. As this migration unfolds, complexity is likely to arise in one of four buckets:

Trade Process

The move from T+2 to T+1 will put pressure on institutional processes simply by asking them to run more quickly. Batching, reconciliation, and real-time processing functions will need to be tested to ensure they can run at higher speeds or with larger trade sizes in order to support current activity. This could be especially impactful for custodians of large asset managers, especially if those clients operate legacy affirmation systems.

Issues could arise in one or more of the following processes:

- Erroneous instructions could prove difficult or impossible to reconcile, resulting in delayed or canceled execution and reputational risks for the party responsible for the error as well as the broker-dealer facilitating the transaction.

- Automated processes with counterparties fail to sync or they process data at the incorrect time, resulting in inaccurate data exchange with less time to correct. This issue may be exacerbated by the shorter time-zone coverage window (see bullet below).

- There will be less time within the settlement cycle to perform the required activities to process a trade or resolve discrepancies. Custodians of large asset managers may be particularly vulnerable here, as these institutions must execute on detailed instructions oftentimes involving multiple accounts and other custodians. Additionally, for some counterparties, removing a full 24 hours from the settlement cycle will eliminate most of the time available to collaborate and coordinate with other market participants to resolve issues.14

Data Process

With less time to validate the instructions and resolve any errors, small differences in how trade data is captured will take on greater importance. The standardization and/or automation of instruction data will likely become an important part of building resiliency.

Issues could arise in one or more of the following data capture and processing functions:

- Trade data is incorrectly captured, resulting in inaccurate or canceled trades. This could be exacerbated if some market participants opt to continue settling T+2.

- Real-time account data could be unavailable, with less time to identify and resolve any issues. For instance, has an account with an introducing broker-dealer initiated a recall of loaned securities that was not communicated to the clearing broker?

- A key compliance or regulatory step is missed or inaccurately completed due to an inability to reconcile or resolve data discrepancies. Macro issues of this sort should be minimal given the depth of industry engagement. However, market participants should review their internal processes in detail to ensure that any critical paths are identified and accounted for. For example, institutions should identify and map any steps that are currently keyed to the second night cycle after a trade (the night prior to the current settlement date).

Planning

Daily planning for banks and broker-dealers becomes more difficult due to the shortened time to secure financing for trades, with the potential for increased volatility as a “new normal.” Increased volatility could also exacerbate model risk as changes to short-term funding activity diverge from historical norms, putting pressure on pricing and capital models.

The difficulty planning for funding needs on a tighter timeframe might arise in the following ways:

- A counterparty is unable to secure sufficient financing to complete a trade, resulting in a fail. The market could be especially susceptible to this during the transition period, notwithstanding all the testing and preparation currently underway. An increase in fails could impact liquidity in specific securities or disrupt the securities lending market.

- Alternatively, institutions may systemically “overfund” each day to avoid fails, increasing volumes in the short-term repo market as well as cash held on balance sheets. If done systemically, this behavior could create its own unintended consequences due to the impact on liquidity and returns.

- Sudden volatility resulting from intraday or overnight funding needs causes capital or pricing models to breach thresholds, resulting in technical market risk. This could also exacerbate model risk, as unexpected activity diverges from historical (or even recent) norms, skewing the market signals used for forecasting and compliance monitoring.

- Institutions may turn to derivatives or other instruments to a greater extent than previously utilized to compensate for some of the operational risks noted here. This could become prevalent if institutions began self-settling certain trades among their own accounts. If that happened, some effects could be:

- Reduced transparency

- Build-up of leverage and risk exposure

- Increased transaction complexity

Monitoring & Operating

Account-level oversight may become more critical, especially if alternative products are used to a greater degree as operational workaround

For instance:

- The impact of changes in volatility on account-level exposures and the need to ensure that accounts stay within required credit, reserves, other limits merit greater monitoring. The need for clear lines of sight into specific accounts was recently highlighted with the recent implosion of the hedge fund Archegos as volatility combined with a concentrated portfolio to overwhelm its capital position.

- Institutions will need to monitor desk coverage to ensure sufficient overlap with global counterparties to facilitate issue resolution. Redundancies and fail-safes will need to be built in to the policies due to the extremely short window during which a lack of coverage could be detected and resolved.

- Review model risk policies and ensure that models are flexible enough or updated frequently enough to account for changed market behaviors.

Strategic Opportunities

Institutions will have a multitude of operational steps to ensure they are ready for the change to T+1. Some may also take this opportunity to re-evaluate their strategies and service offerings to capitalize on things they do well. For instance:

- Does an institution have superior matching or automation tools that could be sold as a separate service? Can these tools support a wider range of trade terms or resolve a wider range of discrepancies than standard tools?

- Does an institution have the operational and capital capacity to support introducing broker-dealers and asset managers who wish to self-settle transactions among their accounts on more flexible terms?

- What efficiencies can institutions gain in estimating their daily funding needs that could support increased lending or lower funding costs?

- Can a derivatives desk benefit from doing business with institutions that seek a workaround to the new standard or that identify opportunities to profit from changes in the short-term funding market?

Conclusion

The industry migration to T+1 settlement looks like a foregone conclusion, at least for U.S. equities. Industry engagement and the successful navigation of previous cycle reductions should provide confidence in the successful execution of the DTCC’s latest proposal. However, investors, broker-dealers, and banks will need to review their policies and operational processes and tools to ensure their franchise is protected during the transition. Moreover, institutions with noted advantages or disadvantages may seek to update their strategies to capitalize on the increased need for standardization, process automation, and funding predictability

References

- DTCC. DTCC Proposes Approach to Shortening U.S. Settlement Cycle to T+1 Within 2 Years. Feb 24, 2021.

- ID.

- DTCC. Advancing Together: Leading the Industry to Accelerated Settlement (PDF). (Pg. 8.) Feb 2021.

- NSCC accomplishes this through its Continuous Net Settlement (CNS) process.

- CNBC. Wall Street clearing firm proposes 1-day trade settlement after Robinhood controversy. Maggie Fitzgerald. Feb 24, 2021.

- See 1.

- SIFMA. A Shorter Settlement Cycle: One Step at A Time. Kenneth E. Bentsen, Jr. Jun 15, 2021.

- See 12 CFR 12.9; 220.2; and 344.7.

- In light of the supportive statements offered by SIFMA and ICI, this is likely a foregone conclusion.

- Federal Register. Securities Transaction Settlement Cycle. Mar 29, 2017.

- See 1.

- SIFMA. A Shorter Settlement Cycle: T+1 Will Benefit Investors and Market Participant Firms by Reducing Systemic and Operational Risks. Kenneth E. Bentsen, Jr., Eric J. Pan and Michael C. Bodson. May 4, 2021.

- See 5.

- The International Capital Markets Association covered this issue well in a 2014 white paper related to the move to T+2. See The impact of T+2 settlement on the European repo market: A report by the ICMA European Repo Council’s Operations Group (PDF), pg. 6–7.

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.