The Payments Race Navigating Disruption in the Global Payments Landscape: Top 10 Trends for Financial Institutions to Watch

May 2023

Straight To The Point

It’s hard to imagine a world where we relied less on digital payments than today. In the blink of an eye, the world of payments transformed from cash, coins, and checks to digital payments. Fintech and pure-play technology companies continue to unlock new payment methods with innovative solutions that are disrupting the incumbents in the financial services industry, such as retail and commercial banks.

Emerging technologies and new payment solutions are developing faster now than ever before. The rate of change was further spurred by the COVID-19 pandemic. Global lockdowns and quarantine regimens forced consumers and businesses to evolve how they transact, including an agile and rapid shift toward digital payments amidst working from home and concerns over transmission through traditional, in-person currency exchange and card-based payments.

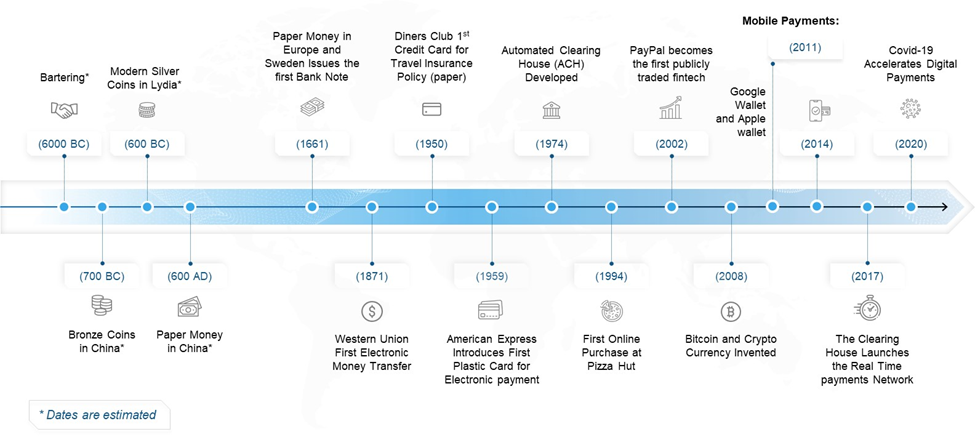

Adoption cycles in the payment ecosystem were not always at the accelerated pace that we are witnessing today as depicted with the timeline below:

Key Milestones in the History of Money and Payments

Winning significant market share across the globe won't be easy for any single player or even one dominant payment method. The payments industry is undergoing a period of rapid transformation, driven by technological advancements, evolving consumer preferences, and regulatory changes. Traditional financial service providers now face competition from technology companies such as Apple and fintech companies, putting pressure on traditional revenue models. These days, it is difficult to distinguish a potential competitor from an ally or partner in the payments space.

Financial services companies that remain a step ahead – continuously testing and learning with customers, both consumers and businesses, and investing in new payment capabilities – will be well-positioned to capitalize on shifts occurring now and those that gain traction in the future. In this paper, we identify 10 trends that have the potential to further disrupt the payments landscape for Financial Institutions:

- Continued Expansion and Adoption of Digital Payments by Consumers and Businesses

- Growth in Faster Payments

- Influence of Big Tech

- The Cloud Computing Evolution Impact on Payments

- An Evolving Regulatory Landscape

- Transformational Impact of Artificial Intelligence and Machine Learning

- Cybersecurity, Fraud and Data Privacy Concerns

- Unique Challenges of Cross-border Transactions

- The Buy Now Pay Later (BNPL) Boom

- Emergence of Digital Currencies and Blockchain: Long-Term Disruption Potential

Continued Expansion and Adoption of Digital Payments by Consumers and Businesses

Continued Expansion and Adoption of Digital Payments by Consumers and Businesses

The continued expansion and adoption of digital payments by consumers and businesses are reshaping the way they transact. This is forcing financial services companies to adapt payment offerings as customers, especially tech-savvy Gen Z and Millennials, increasingly expect seamless, secure, immediate, and personalized experiences.

Digital experience leaders like Apple Pay and Google Pay are leading mobile payment solutions, while PayPal has a strong presence in online payments. Wearables, such as smartwatches and fitness trackers, are also gaining traction as payment devices, further expanding the scope of digital payment options.

As mobile payments, digital wallets, and wearables continue to grow, financial institutions may face challenges in retaining customers and maintaining transaction fee revenues. Fintech companies may further disrupt the industry by offering innovative features, lowering fees, or further improving user experiences, forcing traditional financial institutions to reevaluate their strategies and adapt to the changing landscape.

In response, innovative solutions like Paze, an upcoming digital wallet operated by Early Warning Services and backed by seven of the nation's largest banks, have the potential to disrupt the payments landscape by offering customers a more convenient and secure way to manage their finances. Once launched, such solutions can combine various banking and payment functions into a single platform, streamlining transactions and enhancing user experiences.

The increasing influence of blockchain technology in the payments space also has the potential to further accelerate the adoption of digital payments. By offering greater security, transparency, and efficiency, blockchain can enable faster and more secure transactions, attracting more users to digital payment solutions.

In summary, the continued expansion and adoption of digital payments by consumers and businesses, driven by the influence of younger generations and technological advancements such as blockchain, presents both challenges and opportunities for financial institutions. To remain competitive, institutions must adapt their strategies and offerings, considering factors like innovative fintech solutions and the need for financial inclusion.

Growth in Faster Payments

Growth in Faster Payments

The growth in faster payments is driving a shift towards more efficient payment processing across the globe. Faster payments encompass both real-time payments, which are processed immediately, and near real-time payments, which have a slight delay but are still significantly faster than traditional payment processing times. Countries like the United Kingdom, India, and the United States have implemented or are in the process of implementing faster payment systems to address the increasing demand for instant payment services.

Faster payments are "transforming the payments landscape, enabling faster fund transfers, and compelling financial services companies to adapt their payment infrastructures to meet increasing demands for efficient payment solutions. It's crucial for financial institutions to understand the differences between real-time and near real-time payments, as they serve different use cases and require distinct approaches for implementation.

Real-time payments, such as The Clearing House's RTP system and the Federal Reserve's FedNow service (expected to launch in July 2023), settle funds instantaneously, providing immediate liquidity to recipients. Payment providers such as PayPal, Venmo, and Zelle create the illusion of real-time transfers for consumers in many cases, but depending on the specific transaction, the actual settlement of funds may take longer.

As faster payment systems become more widely adapted, financial institutions need to invest in robust and agile technology to support the increasing demands for instant and seamless transactions, reassess their existing payment processing capabilities and invest in infrastructure upgrades to remain competitive. Preparing for real-time payments can be particularly challenging, as it often requires significant changes to payment infrastructures and processes, as well as robust risk management and compliance measures.

Additionally, payment rails are modernizing to support the increasing demand for faster and more efficient transactions. Fintech companies and innovative payment platforms are further driving the push for real-time and faster payment solutions, potentially disrupting traditional banking services by offering improved transaction speeds, lower fees, and enhanced customer experiences. This may force established financial institutions to reevaluate their strategies and adapt to the changing landscape.

To stay competitive, organizations must invest in infrastructure, reassess payment processing capabilities, and adapt to the evolving landscape driven by fintech innovations, modernizing payment rails, and changing customer expectations. Understanding the distinctions between real-time and near real-time payments and selecting the appropriate solution for their specific use cases will be key for financial institutions in this rapidly evolving environment.

Influence of Big Tech

Influence of Big Tech

The increasing influence of big tech companies such as Apple, Google, Amazon, Meta, PayPal, and Square is driving significant change and challenging traditional financial institutions. These companies are leveraging advanced technologies, data-driven insights, and innovative business models to disrupt the payments landscape and capture market share.

For example, Apple has recently launched a high-yield savings account in partnership with Goldman Sachs, as well as expanded its financial services offerings with Apple Pay Later. JPMorgan Chase CEO Jamie Dimon has referred to Apple as a bank, stating in June last year, "It may not have insured deposits, but it’s a bank. If you move money, hold money, manage money, lend money — that’s a bank." He also warned investors of the looming threat posed by large tech companies, saying they have "enormous resources in data and proprietary systems — all of which give them an extraordinary competitive advantage."

Big tech companies are not only making inroads in the payments space with solutions such as Amazon Pay, Apple Pay, Google Pay, and Meta's payment offerings but also in the B2B domain. Technology-driven companies are harnessing automation, artificial intelligence, and data analytics to provide faster, more efficient, and secure payment experiences for businesses, although the specific extent of these benefits is still being assessed.

The entry of big tech companies and the emergence of technology-driven solutions have led to increased scrutiny from regulators. Financial institutions should stay informed about potential regulatory changes and be prepared to adapt their operations accordingly to maintain compliance and mitigate risks.

As the lines between payments and technology continue to blur, traditional banks and financial service providers must reassess their strategies and invest in digital transformation initiatives to keep pace with the rapid innovation and customer-centric approach of technology-driven competitors. By embracing the convergence of technology and payments, financial institutions can position themselves for success in this rapidly evolving industry.

The Cloud Computing Evolution Impact on Payments

The Cloud Computing Evolution Impact on Payments

The evolution of cloud computing is disrupting the payments industry, enabling financial institutions to benefit from increased efficiency, flexibility, and scalability in their payment processing capabilities. As more organizations migrate their payment systems to the cloud, traditional financial institutions must adapt to this trend to stay competitive in the evolving landscape. Despite the potential advantages, many financial institutions have not been as aggressive in adopting cloud solutions, primarily due to security concerns and the sensitive nature of the data they handle.

This reluctance to fully embrace cloud computing often leads to the implementation of a hybrid environment, which combines the benefits of both private and public cloud environments while maintaining some on-premise infrastructure for added security and control. The hybrid cloud model attempts to balance the advantages of cloud deployment with the need for security, offering a solution that strives to meet the demands of financial institutions.

However, the hybrid cloud model does present challenges for financial institutions, particularly in terms of compliance and data management. The massive shift in the amount of data generated, particularly due to the increase in electronic communication channels during the pandemic, can overwhelm legacy archiving solutions, potentially making it more challenging for financial institutions to monitor market abuse and meet regulatory requirements. Additionally, the complexity of on-premise data management applications and their legacy infrastructure can hinder financial institutions' ability to adapt to new technologies such as machine learning and artificial intelligence.

To overcome these challenges, financial institutions must outline an integration strategy that keeps security as the focal point throughout the process. This includes ensuring visibility for each vendor or system involved, incorporating automated processes to save on overall spending, and identifying potential risks and recovery options. Streamlining operational efficiency, understanding compliance requirements, and educating employees on new best practices are also crucial steps in the successful adoption of hybrid cloud solutions.

In conclusion, as the cloud computing landscape continues to evolve, financial institutions must carefully navigate the challenges presented by hybrid environments and other aspects of cloud adoption. By implementing robust strategies and embracing secure, flexible solutions, financial institutions can leverage the power of cloud computing to enhance their payment systems and overall operations.

An Evolving Regulatory Landscape

An Evolving Regulatory Landscape

The ever-evolving regulatory landscape presents both challenges and opportunities for financial institutions in the payments industry. Changes in regulations can drive disruption, as they often require adjustments to existing business models, investments in new technology, and reevaluation of risk management strategies.

In the United States, regulations such as the Dodd-Frank Act and the Durbin Amendment have had significant impacts on the payments sector, affecting interchange fees and debit card transaction routing. Globally, the implementation of the General Data Protection Regulation (GDPR) in Europe has led to increased emphasis on data privacy and security in the payments industry. Additionally, the adoption of open banking frameworks, such as the European Union's Revised Payment Services Directive (PSD2), is driving innovation and competition in the payments space.

Open Banking, a regulatory-driven initiative, has emerged as a significant disruptor in the payments industry. By allowing third-party developers to access customer account information through secure Application Programming Interfaces (APIs), Open Banking is creating new opportunities for innovation and collaboration between financial institutions, fintech companies, and other stakeholders. This promotes the development of new payment solutions, which can improve the customer experience and foster competition in the market. Financial institutions should adapt to the Open Banking environment and be prepared to capitalize on the opportunities it presents while addressing the associated risks and regulatory requirements.

Data localization is another regulatory challenge that financial institutions face in the payments industry. As countries increasingly mandate that data related to their citizens be stored and processed within their borders, financial institutions must navigate these requirements while maintaining the efficiency and security of their payment systems.

Increased regulatory scrutiny on cryptocurrencies, as seen with the recent attention on crypto exchanges like FTX, highlight the need for financial institutions to be vigilant in monitoring the rapidly changing landscape of digital currencies and their associated regulations.

The regulatory landscape around cryptocurrency and digital assets is continually evolving, with countries implementing different approaches to the regulation of these assets. Financial institutions must stay abreast of these developments and ensure their payment systems are compliant with the relevant regulations.

Fintech companies and other non-traditional players entering the payments industry can further drive disruption by introducing innovative solutions that challenge existing regulations or take advantage of regulatory gaps. Financial institutions should monitor the competitive landscape and be prepared to adapt their strategies in response to new entrants and emerging technologies.

Transformational Impact of Artificial Intelligence and Machine Learning on Financial Services

Transformational Impact of Artificial Intelligence and Machine Learning on Financial Services

Artificial intelligence (AI) and machine learning (ML) technologies have the potential to significantly disrupt the payments industry, offering new opportunities for innovation, efficiency, and enhanced customer experiences.

AI and ML can be leveraged to automate various aspects of the payments process, from fraud detection and prevention to transaction processing and risk management. For example, machine learning algorithms can quickly analyze large volumes of transaction data to identify patterns and anomalies, helping financial institutions more effectively combat fraud and reduce false positives.

In addition to fraud detection, AI and ML technologies can be employed to streamline and optimize payment processing, reducing manual intervention and speeding up transaction times. This can improve operational efficiency for financial institutions, while also delivering faster and more seamless payment experiences for customers.

AI-powered chatbots and virtual assistants are another area of innovation in the payments space, enabling financial institutions to provide personalized, real-time customer support and transaction assistance. As these technologies continue to evolve, they may disrupt traditional customer service models, prompting financial institutions to reassess their strategies and invest in AI-driven solutions.

Quantum computing, an emerging technology, has the potential to drive even further disruption in the AI and ML space. By significantly increasing processing power and speed, quantum computing could revolutionize the capabilities of AI and ML algorithms, leading to more transformative changes in the payments industry.

Financial institutions should be prepared to adapt their strategies and invest in these emerging technologies to remain competitive and benefit from the transformative potential of AI and ML.

Cybersecurity, Fraud and Data Privacy Concerns

Cybersecurity, Fraud and Data Privacy Concerns

As the payments landscape becomes more digital, the risks associated with cyber-attacks, data breaches, fraudulent transactions, and payment fraud have grown significantly. Financial institutions should be prepared to address these threats by investing in cutting-edge cybersecurity solutions, such as fingerprint scanning, facial recognition, and voice authentication, and implementing robust data privacy practices to protect sensitive customer information.

In addition to cybersecurity measures, financial institutions must also prioritize fraud prevention in payments. This includes monitoring transactions for signs of fraud, implementing machine learning algorithms to detect unusual patterns, and employing multi-factor authentication to verify the identity of users. As fraudsters continue to develop sophisticated methods for circumventing security measures, financial institutions should remain vigilant and constantly update their fraud prevention strategies to stay ahead of emerging threats.

Regulatory changes, such as the European Union's General Data Protection Regulation (GDPR), have further emphasized the need for financial institutions to prioritize data privacy, security, and fraud prevention. In response, companies must continuously update their risk management strategies and ensure that their cybersecurity measures are aligned with evolving regulatory requirements.

Fintech companies and other innovative players in the payments space can also drive disruption by offering advanced security solutions and fraud prevention tools that challenge traditional approaches to cybersecurity, data privacy, and fraud mitigation. Financial institutions must monitor these developments and be prepared to adapt their security and fraud prevention strategies to stay ahead of emerging threats.

Moreover, as customer expectations for secure, private, and fraud-free payment experiences continue to rise, financial institutions that are proactive in addressing cybersecurity, data privacy, and fraud concerns will be better positioned to retain customer trust and loyalty.

By investing in advanced security technologies, prioritizing data privacy, and adapting to evolving regulatory requirements, as well as implementing comprehensive fraud prevention strategies, companies can position themselves to successfully navigate this disruptive landscape and maintain customer trust.

Unique Challenges of Cross-border Transactions

Unique Challenges of Cross-border Transactions

Cross-border transactions present unique challenges for financial institutions including high transaction costs, slow processing times, and complex regulatory compliance requirements. Overcoming these challenges is essential to meeting the growing demand for faster, more efficient, and cost-effective international payment solutions.

Innovative payment platforms and technologies, such as blockchain and digital currencies, have the potential to disrupt traditional cross-border payment processes by offering faster transaction times, reduced fees, and increased transparency. The adoption of messaging standards like ISO 20022 can also streamline and harmonize cross-border transactions, facilitating smoother communication between different financial institutions and improving the overall efficiency of the process.

Traditional financial institutions are not merely passive observers of the ongoing disruption in cross-border transactions. Many have taken proactive steps to adapt to the changing landscape by investing in innovative payment platforms and technologies, partnering with fintech companies, or developing their own solutions. By embracing innovation, these institutions demonstrate their commitment to meeting the growing demand for faster, more efficient, and cost-effective international payment solutions, while maintaining a competitive edge in the market.

The growing adoption of real-time payment solutions in domestic markets may also impact cross-border transactions, as customer expectations for immediate and seamless payments extend beyond national borders. Financial institutions that can adapt their infrastructures and offerings to accommodate real-time international payments will be better positioned to capture market share and retain customer loyalty.

Regulatory changes, such as the European Union's revised Payment Services Directive (PSD2) and the increasing focus on anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, continue to shape the cross-border payments landscape. Financial institutions should remain vigilant in monitoring and complying with these evolving regulations to maintain their competitive edge.

Fintech companies and other innovative players in the payments space can further drive disruption in cross-border transactions by providing more convenient and cost-effective solutions, challenging traditional banking services. Financial institutions must closely monitor these developments and be prepared to adapt their strategies to stay ahead of the competition.

By investing in innovative technologies, monitoring regulatory changes, and adapting to evolving customer demands, companies can position themselves to successfully navigate this disruptive landscape and stay competitive in the global payments market.

The Buy Now Pay Later (BNPL) Boom

The Buy Now Pay Later (BNPL) Boom

The rapid rise of Buy Now Pay Later (BNPL) services has disrupted the traditional consumer credit market, providing an alternative to credit cards and loans for consumers looking to finance their purchases. BNPL services, which allow customers to defer payments or split them into smaller installments, are becoming increasingly popular due to their convenience, ease of use, and the potential for reduced interest costs.

Leading BNPL providers such as Affirm, Afterpay, and Klarna have experienced significant growth, driven by strong demand from both consumers and merchants. The growing popularity has not only attracted the attention of big tech companies like Apple, which has entered the BNPL market with Apple Pay Later, but has also prompted traditional financial institutions to reevaluate their credit offerings and consider incorporating BNPL solutions into their product portfolios.

Some banks have taken a leading role in the BNPL market, aiming to capitalize on the growing demand for alternative payment options. Institutions such as American Express, JPMorgan Chase, and Citi have introduced their own BNPL solutions, such as "Pay It Plan It" by American Express, "My Chase Plan" by JPMorgan Chase, and "Citi Flex Pay" by Citi. These banks offer their customers flexible payment plans with fixed fees or APRs that are often equivalent to or less than the interest rates they would pay if they carried a balance on their credit cards. Other banks, like Goldman Sachs, have ventured into this space, while some are exploring partnerships with established BNPL providers to offer competitive financing options.

As BNPL continues to gain traction, financial services companies may face challenges in retaining credit card customers and maintaining interest revenue, as consumers increasingly turn to alternative financing options. This disruption could also extend to the B2B space, where businesses may begin to seek out more flexible payment solutions for their transactions. B2B BNPL offers numerous benefits to both buyers and sellers, such as streamlined processes, improved cash flow, reduced credit and fraud risk, increased conversion rates and average order value, and enhanced customer retention. By adopting B2B BNPL solutions, businesses can leverage these advantages to create a more efficient and customer-centric purchasing experience, potentially reshaping the landscape of B2B financing.

Innovation in the BNPL space is also driving further disruption, as new entrants and established players alike develop more advanced, user-friendly solutions. Financial institutions must carefully monitor these developments and be prepared to adapt their strategies and offerings to remain competitive in the evolving consumer credit landscape.

By closely monitoring market developments, investing in innovation, and adapting to shifting consumer preferences, companies can position themselves for success in the dynamic world of consumer credit.

Emergence of Digital Currencies and Blockchain: Long-Term Disruption Potential

Emergence of Digital Currencies and Blockchain: Long-Term Disruption Potential

The emergence of digital currencies, including Cryptocurrencies, Stablecoins, and Central Bank Digital Currencies (CBDCs), presents potential disruption to the payments industry. These digital assets offer the promise of faster, more efficient, and secure transactions, challenging traditional financial institutions to adapt and innovate.

Cryptocurrencies like Bitcoin and Ethereum, as well as stablecoins such as Tether and USD Coin, have made some progress as alternative payment methods, offering lower fees and faster transaction times. Meanwhile, CBDCs, like the digital yuan in China and the digital rupee in India are being developed by central banks to modernize their countries' financial systems and enable more efficient and secure payments.

Forward-thinking financial institutions have already begun exploring the potential of digital currencies and blockchain technology, investing in research and development, and even partnering with fintech companies to develop innovative solutions that leverage these emerging technologies.

In the short term, financial institutions may be less focused on digital currencies and blockchain technology due to the recent challenges in the industry, including the volatility of cryptocurrencies and the so-called "crypto winter" that we recently encountered with an extended period of pricing weakness. However, it is essential for these institutions to monitor the long-term potential of these technologies as they continue to evolve and gain traction.

As digital currencies continue to develop and mature, financial institutions may need to reassess their existing payment processing capabilities and consider integrating digital asset solutions into their offerings. This may involve investing in new infrastructure, partnering with fintech firms, and navigating complex regulatory environments to ensure compliance.

Furthermore, blockchain technology, which underpins many digital currencies, has the potential to revolutionize various aspects of the payments industry. Its decentralized, transparent, and secure nature could drive further disruption by enabling innovative use cases such as cross-border transactions, smart contracts, and tokenization of assets.

Decentralized Finance (DeFi) platforms, which leverage digital currencies and blockchain technology, are another disruptive force in the financial industry. These platforms offer alternative financial services, such as lending, borrowing, and investing, without the need for traditional intermediaries like banks, thus challenging the status quo in the payments sector.

Though the short-term focus of financial institutions may be on more immediate challenges, the rise of digital currencies, DeFi, and the underlying blockchain technology still poses a significant long-term challenge to the traditional payments landscape. Financial institutions should reevaluate their strategies and adapt to the evolving digital economy, preparing for the future impact of these disruptive technologies.

Conclusion

The payments landscape is undergoing significant disruption, presenting both challenges and opportunities for financial services companies. By understanding and proactively addressing these top 10 trends, businesses can position themselves for success in this rapidly evolving industry. Financial Institutions should understand how they can efficiently and effectively transform their organization to offer distinctive value to their customers, creating new avenues for digital experiences and payments.

This evolution in the financial services industry is not only targeting technology and processes, but also requires a shift in mindset and organizational culture. Financial Institutions that are committed to innovation, strategic investment, and fostering collaborative partnerships with fintech companies and other stakeholders in the payments ecosystem will be best positioned to thrive in this dynamic landscape.

As John C. Maxwell aptly stated, "Change is inevitable. Growth is optional." Being ready for digital payments and disruption in the payment domain is not just a nice-to-have anymore; it is essential for Financial Institutions to remain competitive. The ability to adapt and respond to an ever-changing market will be a crucial factor in determining which institutions are well-positioned to thrive in the evolving payments landscape.

At Reference Point, we specialize in helping financial services companies navigate these disruptions, offering tailored solutions and expert advice to stay ahead of the curve. Our team of experienced professionals is dedicated to supporting our clients in identifying growth opportunities, developing innovative payment strategies, and ensuring compliance with regulatory changes. Together, we can help you seize new opportunities and thrive in the dynamic payments market. Visit www.referencepoint.com for more information or contact us at: digitalandtechnology@referencepoint.com.

Table of Contents

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.