Pre-Integration Planning Lessons Learned, Best Practices and Frameworks for an M&A Implementation

April 2025

Straight To The Point

Navigating the complex landscape of mergers and acquisitions (M&A) is a daunting challenge for any organization. While M&A presents opportunities for growth and synergies, a significant portion of these corporate endeavors fail to reach their projected outcomes. Three challenges to success manifest in various forms, including cultural misalignment, ineffective communication and poor execution - such as delays in decision-making, lack of coordination across workstreams, insufficient attention to workforce integration, and ineffective execution strategies. As Benjamin Franklin famously said, “By failing to prepare, you are preparing to fail."

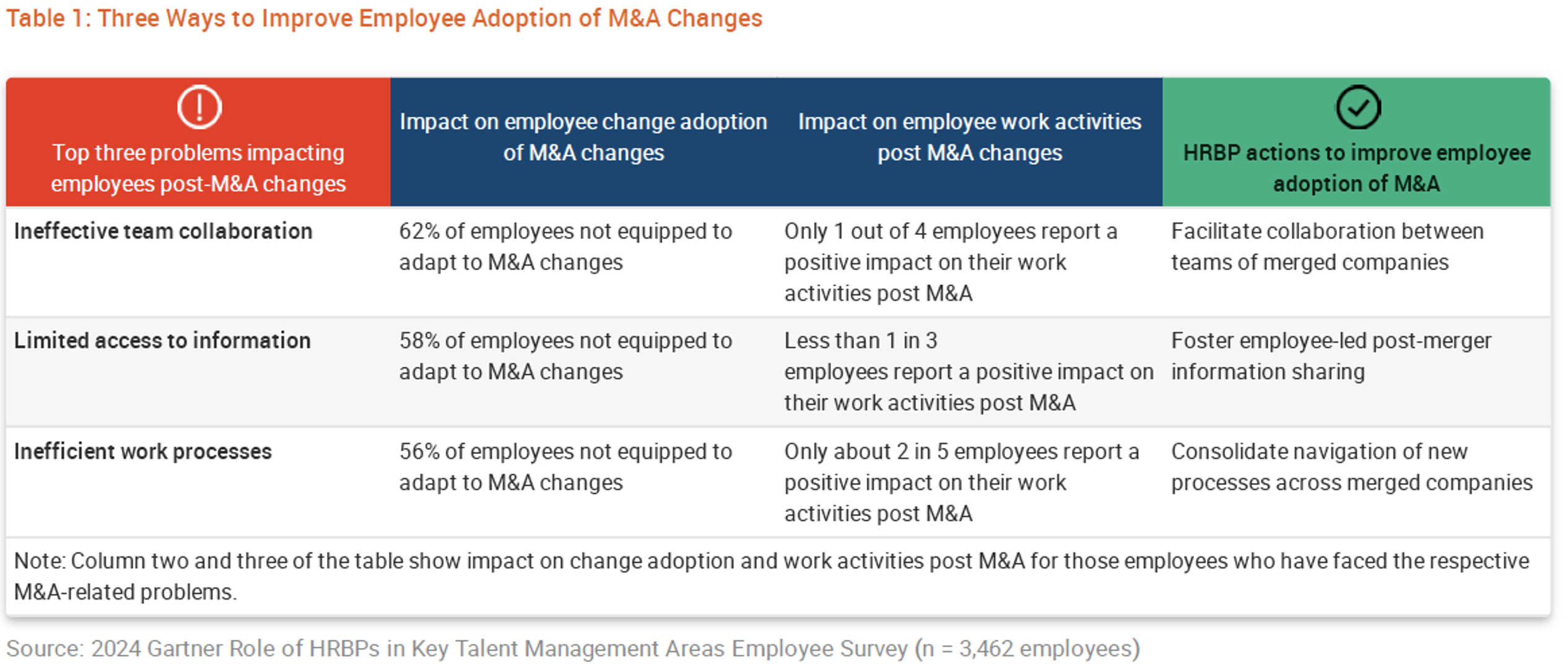

The consequences of poor planning are well-documented. A 2024 Gartner survey reveals that 56% of employees felt ill-prepared to adapt to M&A changes, citing inefficient work processes, while 62% attributed their lack of readiness to ineffective team collaboration. This points to a fundamental issue: lack of proper planning. Without clear, strategic preparation in both workflows and team coordination, organizations are setting themselves up for failure in navigating the complexities of post-merger integrations.

Success in post-merger integrations hinge on early, strategic pre-integration planning. Pre-integration planning refers to the critical activities undertaken before the integration execution activities kick-off (when project work is assigned and team members from both organizations are mobilized). Typically, pre-integration planning happens immediately after due diligence, during the pre-close planning phase, but some companies may postpone integration activities until a later date –even years—after an acquisition is completed. Regardless of when pre-integration planning starts, the work in this phase is dedicated to laying the underlying foundation for the integration to be a success - ensuring the structure and foundation is in place for the program, addressing potential obstacles, and setting the stage for realizing the intended value of the merger.

Note that “Day 0” in the graphic above refers to the formal launch of the integration program, when the broader team is mobilized and workstreams are activated to continue the pre-integration planning. Up until this point the pre-integration planning phase is typically comprised of a smaller group planning for “Day 0”.

The rest of this paper will share a list of the common challenges organizations face in the execution of a post-merger integration, a set of best practices during the pre-integration phase to prepare for those challenges, and a basic framework that can be used as a baseline for an engagement of this nature.

Key Challenges in a Post-Merger Integration

Post-merger integration is a complex process with numerous potential pitfalls. The challenges listed below represent some of the most common obstacle’s organizations face when combining two entities. These challenges set the stage for why thorough pre-integration planning is critical. In the next section, we identify best practices during the preliminary integration planning phase to help mitigate these issues and lay a strong foundation for success.

- Information Barriers and Pre-Close Limitations: Limited information sharing prior to deal closure can hinder the development of an effective target operating model and delay detailed integration planning. These restrictions are often driven by antitrust and regulatory considerations. Companies must work within these constraints and establish processes that will facilitate knowledge transfer prior to deal close in a secure manner. This requires a structured approach with traceability where each information request is reviewed by legal and compliance teams, and if approved, shared only with specific named individuals thorough controlled and secure channels.

- Cost and Complexity: Managing the financial and operational burden of integration activities, including unforeseen expenses, can strain resources and delay progress. Integration budget and financial discipline will be required. Often companies do not ‘finish’ the integration before the M&A funding runs out—leaving a higher running cost and a struggle to finance the remaining integration activities out of business-as-usual (BAU) budgets. This is especially acute in the technology space, where decommissioning legacy systems is often complex, time-consuming, and costly.

- Business Processes: Re-evaluating and harmonizing existing business processes across merging entities can be daunting, particularly when the organizations have differing levels of process automation, geographic locations, and maturity. When choosing the “best” processes, it is important to carefully consider all options – and ensure both sides feel heard.

- Legal and Regulatory Issues: Navigating the compliance landscape and meeting diverse regulatory requirements can be a significant challenge. The acquired entity may be subject to heightened compliance standards imposed by the acquiring organization, including stricter financial controls, data security policies, and regulatory reporting requirements. Aligning the acquired entity with these more stringent policies can be complex and time-intensive, requiring a structured approach to ensure compliance while maintaining operational continuity.

- Poor Execution: Even with robust plans, execution failures can occur due to unclear decision-making processes, misaligned priorities, lack of coordination between workstreams, and insufficient oversight. Ineffective team collaboration—resulting from siloed teams, inconsistent communication, and competing integration goals—further exacerbates execution challenges, leading to delays and inefficiencies. Without a structured approach to program execution, organizations may experience delays, cost overruns, and disruption to business operations. Effective integration requires strong leadership, well-defined accountability structures, and a disciplined approach to managing interdependencies across teams.

- Cultural and Organizational Misalignment: Integrating disparate organizational cultures and aligning operating models can create friction and disrupt progress. Joining two different cultures is inherently challenging—cultural roadblocks can divert focus from key integration activities. Legacy allegiances will naturally persist, and establishing a meritocracy-driven organizational structure can encourage desired behaviors.

- Transformation Management: Without effective transformation management, integration efforts can become disjointed, leading to misaligned objectives and unrealized synergies. A well-structured program must include clear governance, defined roles, and disciplined oversight to ensure accountability across all integration workstreams. Establishing a dedicated integration management office (IMO) and governance structure helps coordinate activities, track progress, and manage interdependencies between teams.

- Integration Risk Management: Mergers often introduce operational, financial, and reputational risks. Without a structured risk management framework, organizations may struggle to identify, assess, and mitigate potential disruptions. Risk assessment processes should be built into the integration plan.

- IT Integration and Organizational Structure: The challenge of integrating IT systems, data, and infrastructures can be significant, especially when the merging entities have disparate technology frameworks and structures. Even when companies use the same tools (e.g., JIRA, ServiceNow, or Workday), variations in configuration, workflows, and data structures can create compatibility issues, increasing integration complexity. Selecting target state technology, while considering suites of applications versus parts of systems, is crucial to ease integration and reduce overall technical complexity.

- Unforeseen Challenges: Even with meticulous planning, unforeseen challenges often arise during post-merger integration, requiring agility and contingency plans to address them promptly. Without effective program management, integration efforts can become disjointed, leading to misaligned objectives and unrealized synergies.

Summary of the Challenges of a Post-Merger Integration

Merging two organizations presents a variety of challenges, from regulatory hurdles to cultural friction and execution roadblocks. A 2024 Gartner survey highlights some of the most pressing issues employees face post-merger, reinforcing the need for proactive planning to minimize disruption. Table 1 below illustrates how ineffective team collaboration, lack of information access, and inefficient processes negatively impact employee adaptation and productivity.

10 Best Practices for Pre-Integration Planning

Every post-merger integration comes with its own nuances and differences, shaped by the organizations involved and the specific goals of the merger. This section outlines 10 best practices to help organizations prepare effectively before officially kicking off the integration program. These recommendations aim to address common challenges and establish a strong foundation for the merger's success.

1. Start Planning Early: Begin integration planning as early as possible—ideally during the due diligence phase—to define the target operating model, outline the integration structure, and identify early risks. Early planning enables organizations to anticipate challenges, align functional priorities, and ensure Day 1 readiness. Engage stakeholders from both sides to establish cross-functional workplans and dependencies. Where information sharing is limited, implement traceable workflow approval processes and tools for sharing sensitive data across through channels.

2. Gain Senior Leadership Support: Secure visible and sustained commitment from senior leadership to drive integration success. Clearly articulate the strategic rationale and business drivers behind the merger—answering “why are we doing this?” early and consistently. Appoint a single accountable integration leader with the authority to mobilize teams, make decisions, and escalate issues as needed. Senior leaders should own the integration business case, outlining expected costs, investments, timelines, operational efficiencies, and risks. This business case becomes the foundation for aligning priorities and making tradeoffs throughout the program.

3. Establish Governance Structures and Decision-Making Frameworks: Create a centralized governance body staffed with sufficient resources to represent both organizations effectively. Ensure that roles and responsibilities are clearly defined and avoid assigning this responsibility as a part-time task to employees with existing full-time roles. Proper staffing of the engagement is essential to ensure governance bodies can function effectively.

Beyond defining governance structures, it is critical to establish clear decision-making protocols to prevent bottlenecks. Escalation paths should be well-defined to resolve roadblocks efficiently and ensure integration progress is not stalled due to ambiguity or delays.

4. Setup Workstream Structure: Create an optimal set of workstreams to allow for delegation of the integration work. Assign business leads and project managers early on to each workstream to maintain focus and coordination. Workstream leaders should be empowered to make decisions within their scope and the framework of the overall program. Encourage cross-functional participation and collaboration by ensuring adequate representation in each workstream. Ensure that the resources identified as critical subject matter experts (SMEs) are setup to be able to balance integration with business-as-usual (BAU) work, with additional support provided to avoid burnout.

5. Streamlining Processes: During pre-integration planning, assess critical processes and identify where alignment will be most important. Engage stakeholders early to ensure both sides feel heard. Consider interdependencies between processes and supporting technologies given their interconnectedness.

6. Enhance Communication and People: Develop a comprehensive communication plan that includes consistent messaging from leadership. Establish a change management function early on to work in tandem with communication efforts, ensuring employee alignment and readiness for integration.

Decisions on people are much more difficult than processes or technologies – it is imperative to move quickly, methodically, and transparently on people decisions.

7. Leverage Effective Tools: Adopt a clear strategy and standards for document management, ensuring data security and appropriate access controls are in place until the legal close. Streamline the process for granting permissions to shared resources, enforce strong service-level agreements (SLAs), and implement auditing mechanisms to maintain transparency and compliance.

Integration tools and platforms must be evaluated early to prevent disruptions during execution. The tooling used by the two technology organizations may differ significantly and pose risks during implementation. Even if both companies use the same software (e.g., JIRA), variations in setup can lead to incompatibility. To mitigate this, establish a standardized approach for tool integration, assess system alignment early in the planning cycle, and develop a structured roadmap for technology convergence.

8. Focus on Customer Experience: Maintain a customer-first perspective throughout the planning phase. Anticipate how integration decisions will impact customer interactions, user experience, and loyalty. Implement a customer impact monitoring approach to proactively identify and resolve any service disruptions throughout the integration, ensuring continued satisfaction and brand reputation.

9. Technology Strategy Alignment: Define a technology roadmap and target-state architecture as early on as possible to reduce unnecessary complexity and integration risks. A strong architecture function is important to understand both what you have today and what you are leaving behind. As the integration roadmap is developed, Day 1 should be as light as possible in terms of technology integration to ensure it is a ‘non-event’ from a systems implementation perspective. Most M&A integrations tend to end up with ”too many systems,” so a post-Day 1 rationalization may be needed.

10. Steering Committee Cadence: Adjust the frequency of executive steering committee meetings to balance the need for oversight with the time required to generate meaningful updates. Weekly meetings can create inefficiencies if too much time is spent preparing materials. Ensure that decisions made in steering committee meetings are documented clearly and communicated to all relevant stakeholders promptly.

Solving the M&A Puzzle: How Proactive Planning Drives Success

Successful post-merger integration is like assembling a complex puzzle—each piece must fit together seamlessly to create a unified organization. Without a clear strategy, missing or misaligned pieces can lead to execution gaps, cultural friction, and operational inefficiencies. By proactively addressing common challenges—such as leadership misalignment, ineffective communication, and lack of execution discipline—organizations can ensure that all critical elements are in place before integration begins.

Strong governance, clear decision-making protocols, and a people-first approach serve as the foundation of this puzzle, keeping all moving parts connected and aligned. While every merger presents unique complexities, a disciplined approach to pre-integration planning minimizes disruption and maximizes long-term value creation. Those who invest the time upfront will ultimately build a stronger, more cohesive organization—where every piece contributes to a successful whole.

Framework for Pre-Integration Planning & Strategic Advisory

Pre-integration planning requires a structured approach to ensure that all critical aspects of the merger are addressed systematically. This framework outlines key phases that organizations should follow to align their strategies, evaluate risks, and set the stage for a successful integration. Importantly, every step of this phase can be completed by a small working team with executive oversight. This allows for faster decision making and encourages creating structure prior to bringing in a large program team. Each phase builds upon the previous one, providing a clear roadmap from vision alignment to execution readiness.

Steps in Pre-Integration Planning

1. Align on Strategy

The first step in pre-integration planning is to align on what integration means for the organization. Strategy workshops are an effective tool to bring together executives and stakeholders around key questions such as:

- What is the strategic rationale for integrating?

- What is the strategic rationale for integrating now?

- What outcomes do we want to achieve in the integration?

- What outcomes do we want to avoid in the integration?

- What timeline do we have for integration work?

- Who needs to be involved in the planning and execution of this work?

2. Confirm the Critical Path

Pre-integration planning stakeholders should challenge themselves to define what decisions and activities are truly on the critical path to start the integration program, as well as what activities will be on the critical path during integration. Are there goals identified that are not related to integration? What decisions can be made after the entities integrate? This exercise is intended to ensure that the scope of integration is focused, and activities that can be handled under separate programs or BAU are not included in the integration scope and budget. Once the critical path is agreed-upon, program leadership should memorialize both pending and finalized decisions to keep leaders on the same page about program facts and help plan communications once the program is officially mobilized.

3. Determine Structure and Governance

Pre-Integration Planning stakeholders should align the program structure, and the roles of the Integration Management Office, to ensure that processes are fit-for-purpose. While centralized program management is essential for large integrations to succeed, it is equally important to delegate as much of the everyday decision making and execution work to the workstreams and project teams executing on the integration work. Generally, the Program should be a centralization point for planning, communications and issue resolution, and should also manage cross-functional approaches and process areas to ensure consistency.

4. Prioritize Scope

With the integration goals, critical path and governance structure defined, the pre-integration planning stakeholders should document the initial list of projects that should be considered in-scope for the integration. Stakeholders should assess the costs and benefits of these projects and their relative priorities. From this exercise, the program leadership can produce a high-level roadmap that summarizes the initial expectations on the integration’s timeline, costs and benefits.

5. Design the Kickoff

The final step for the pre-integration planning team is to define a prescriptive kickoff process to get the program officially up and running. The goal should be to create workstreams, identify people to fill the roles in those workstreams, and ensure all new program team members get consistent and comprehensive training and onboarding. Kickoff activities and communications should enable new team members to get up to speed on the previous decisions that have been made in the pre-integration planning phase, the specifics of their role in the program, and clear guidance on what they are asked to do in the first days, weeks and months after the program commences.

Conclusion

Pre-integration planning is not just a preparatory step; it is the foundation for a successful post-merger integration. Organizations that invest in structured pre-integration planning position themselves to maximize synergies, minimize disruptions, and create sustainable post-merger value. The companies that succeed in M&A are those that treat pre-integration as a strategic imperative—not just a preparatory step. By adopting a structured and proactive approach, organizations can overcome integration challenges, achieve synergies, and foster a culture of collaboration and innovation.

As Abraham Lincoln famously stated, “Give me six hours to chop down a tree, and I will spend the first four sharpening the axe.” The same principle applies to M&A integrations; careful preparation and strategic foresight during pre-integration planning are what ultimately lay the foundation for the success of the post-merger execution.

Partnering with experienced advisors ensures access to the expertise and tools necessary for this phase of the Integration. These advisors bring critical insights to help organizations overcome challenges, achieve synergies, and foster a culture of collaboration and innovation. Time invested in pre-integration planning lays the groundwork for streamlined execution, minimized risks, & sustained post-merger value. The framework and best practices outlined in this paper serve as a guide for building the structure, alignment, and readiness needed to execute a successful post-merger integration.

Table of Contents

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.