Customer Journey Orchestration in Financial Services

June 2020

Straight To The Point

Investing in and embracing Customer Journey Orchestration (CJO) allows organizations to elevate customer service quality standards beyond workforce optimization to encompass the technologies used to deliver a memorable customer service experience. CJO systems deliver an unprecedented amount of information about customer journeys across multiple interactions. By harnessing this information, organizations can not only improve client satisfaction but also increase revenue, deliver more productivity, and enhance employee engagement.

Background

Efficient, courteous, and motivated customer service call centers are table stakes in the financial services sector. Customers expect to be able to speak to a live, knowledgeable, and helpful human being who can answer their questions and fix their problems 24/7. Over the past decade, financial services firms have responded to this need by employing technologies like Customer Relationship Management (CRM) and Interactive Voice Response (IVR) as well as increasing scale by offshoring some, or all, their call centers. The assumption being, if the financial institution can support the increased call volume with well-trained, literate, and cost-effective resources with the right technological support, the company can improve customer service without breaking the bank.

In the meantime, the consumerization of computers (Apple), e-Commerce (Amazon), and Retail (Walmart) has raised the bar in terms of customer service expectations. Yet, no real analog to these iconic companies comes easily to mind in the financial services space. Why is that? There is no simple answer to this question. Many factors come into play that make these three companies iconic.

One common thread is how they have each elevated their customer service game beyond workforce optimization to the next level, Customer Journey Orchestration. Customer journey considerations have been a mainstay in client-facing business applications for a decade. The science and thought process surrounding this set of disciplines (i.e., design thinking, user experience (UX), digital first, and customer centric) now encompasses the technologies used to deliver a memorable customer service experience and gain share of wallet.

Throughout this paper, we will define Customer Journey Orchestration, explore various technologies in this space, identify the challenges these technologies look to solve, and discuss the benefits that can be realized through their implementation.

Financial services leaders can elevate their brand and customer experience by embracing – and investing in – Customer Journey Orchestration.

What is Customer Journey Orchestration

Customer Journey Orchestration (CJO) is the process of proactively managing your customer’s journey from marketing to sales and service.

The technology systems in this space deliver powerful capabilities that when combined provide real-time, actionable customer insights to dramatically improve the customer’s experience, optimize customer service interactions, and accelerate customer engagement innovation.

These systems provide a view into customers’ journeys throughout all touchpoints from marketing to customer service. They allow leaders to interrogate and modify the journey touchpoints and help determine whether the changes made were effective – all in near real-time.

As a general matter, CJO is designed to connect the dots between teams and system to actually manage the customer journey as opposed to passive observations of events as they unfold.

CJO Implementation Phases

The implementation of CJO can be grouped into two buckets: Data Integration & Journey Discovery and Journey Testing & Management.

Data Integration & Journey Discovery

By far, one of the greatest challenges in implementing CJO is identifying and integrating all relevant data sources due to the typical number, volume, and heterogeneity of source systems. Implementation is also a challenge because of the number of potential stakeholders needed as well as achieving organizational consensus and buy-in.

From a CJO perspective, integrating data sources allows for transparency and the ability to expose (discover) portions of the journey that were not previously apparent. This exposure can deliver insights across multiple permutations of the customer journey and help identify the most potential valuable journey hypotheses.

The leading vendor systems in this space allow technology agnostic data ingestion, facilitating the process of integrating journey data seamlessly and quickly. They can deliver robust analytical capabilities allowing detailed introspection (Customer Engagement Analytics) of customer journey workflows and touchpoints in real time.

Journey Testing & Management

Many CJO technology vendors offer comprehensive journey measurement capabilities:

- Test hypotheses

- Determine the effectiveness of changes

- Measure custom-defined Key Performance Indicators (KPIs)

- Evaluate key metrics such as improved Net Promoter Score (NPS), repeat purchases, attrition, and complaints reduction

This data allows the establishment of Return on Investment (ROI) for journey orchestration quickl

Many of these platforms use Artificial Intelligence (AI) and Machine Learning (ML) to deliver insights and predictive models to help course correct and optimize the customer’s service journey in real time leveraging historical and current data.

Benefits of CJO for Customer Service

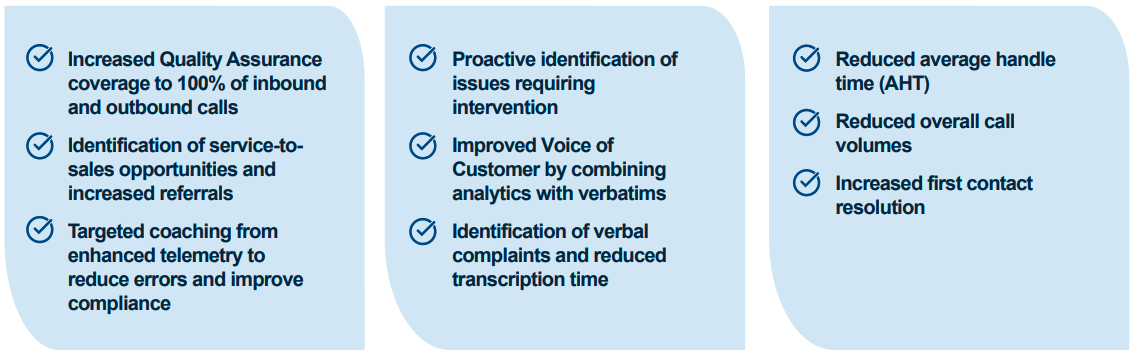

CJO offers numerous benefits for customer services organizations, including but not limited to:

Implementation Considerations

Successful CJO implementation relies on structured change management, upfront data security, and a provable return on investment.

1. Change Management

Developing and implementing the processes and feedback mechanisms to take advantage of Customer Journey Orchestration data is crucial.

Without the coaching mechanisms in place to leverage insights, identifying pockets of non-talk time or negative sentiment spikes will not yield desired benefits.

Anomaly detection to understand why call volumes are overwhelming the call center provides little benefit if agile processes are not in place to organizationally respond in real time.

Digital first, design thinking, customer centric organizations, are one step ahead of competition and are well positioned to gain immediate benefits from Customer Journey Orchestration. A change management program needs to be part of the implementation to maximize the value of what these systems can offer.

2. Data Security

Protecting the data to ensure no client data is compromised is another crucial element.

Besides doing vendor due diligence, a best practice is to make sure all data in-transit and at-rest is encrypted, using data anonymization strategies where it makes sense, and determining the firm’s risk tolerance for using cloud based vs. in-house data center solutions.

Organizations should be prepared for a lengthy internal approval process. In fact, there is an inverse relationship between how complete the data protection strategy is and how long the approval process will take.

3. Proving Return on Investment

These systems require investment. The business case needs to employ a total cost of ownership (TCO) perspective and show an attention to KPI details and associated costs.

If Average Handle Time is improved by 10%, how many FTEs are required, and what call growth can be accommodated with the same staff? What would a 15% increase in service-to-sales referrals translate to from a revenue perspective? These are the kinds of questions the business case should be able to answer to prove ROI.

Organizations should find a specific use case, implement successfully to gain credibility, then iterate. These systems are complex and can do many things. A common miscalculation is attempting to deploy all capabilities at once. Pick a high-value use case, focus on its success, then move on to the next.

Additionally, use as much out-of-the-box as possible and customize as little as practical; this will reduce ongoing maintenance and support and will contribute to a lower TCO.

Conclusion

Customer Journey Orchestration systems are here to stay. They have proven their mettle and are table stakes at high-performing customer-facing organizations. These systems deliver an unprecedented amount of information across all customer touchpoints. Harnessing this information not only improves client satisfaction but also increases revenue, delivers more productivity, and enhances employee engagement.

Table of Contents

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.