Climate-Related Financial Risks Part Two: From Disclosure to Decision

Series September 2021

Straight To The Point

Bankers, risk managers, policymakers, regulators, and investors are increasingly working to better understand the financial risks arising from climate change and its impact on communities around the world. In Part I of our series on the topic, we explored the various approaches taken by regulators and standard-setting organizations to defining climate-risk disclosures for banks. These organizations are especially focused on defining the relevant data, identifying data gaps, and assessing materiality under their respective regulatory frameworks. In the meantime, banks are beginning to align around some standards and incorporate those metrics in their disclosures to investors and other stakeholders.

In Part II of our series on climate-related financial risks, we explore how financial institutions could use this opportunity to better communicate their value proposition. Specifically, this Point of View suggests a model that institutions can use to both meet disclosure obligations and enable day-to-day decision-making that more deeply and consistently supports the overall strategy. (Read Part I here.)

Overview

Climate risk disclosure is emerging as a focus area for financial sector standard setters and regulators around the world. There is not, at present, a globally accepted standard for disclosure requirements. However, given the growing calls for an official standard and wide array of disclosure practices being developed throughout the international finance community, we believe such a standard is forthcoming.

Examples of recent calls for disclosure standards from official bodies include:

- The Biden Administration’s May 2021 Executive Order that, among other things, directs the U.S. executive branch agencies to “advance consistent, clear, intelligible, comparable, and accurate” climate risk disclosures;1

- The U.S. Securities and Exchange Commission (SEC) has solicited public comments on climate change disclosures;2 and

- International regulators such as the Bank of England are examining more closely the financial risks faced by its regulated institutions.3

In addition to the public sector activity, private investors, such as BlackRock, are pressing their portfolio companies to disclose more sustainable investing information.4 Based on the growing chorus from public and private sector stakeholders, we believe broad adoption of enhanced disclosure requirements for climate-related risks is only a matter of time. Enhanced disclosure requirements will confer a number of benefits on the firms publishing the disclosures and the users of these financial reports. They can reasonably be expected to:

- Aid investors in pricing risk more accurately,

- Help stakeholders to better understand the impact of activities on their communities and the environment, and

- Support prudential supervisors in assessing supervised institutions’ management of climate risk.

Beyond the regulatory and supervisory focus, climate risk disclosures can be leveraged as a potential enabler to a holistic Environmental, Social, and Governance (ESG) strategy. Many institutions are using such a strategy as an umbrella for their community investment and social impact strategies. Aligning the climate risk disclosure framework to the larger ESG strategy has clear benefits for a financial institution. For instance, alignment can facilitate cross-pollination across areas and unlock value across the institution. This alignment would also improve the clarity with which a firm communicates the impact of its activities.

The goal of this Point of View is to explain how a financial services institution can leverage its climate disclosures to better align its business operations with its strategy.

The Task Force on Climate-Related Financial Disclosures (TCFD) developed recommendations that offer financial institutions a useful starting point for organizing their analysis.5 The TCFD was organized in 2015 under the auspices of the Basel-based Financial Stability Board (FSB) to promote consistency among firms’ climate-related disclosures. Notably, 31 private companies were part of developing the disclosure recommendations and the TCFD framework has since gained the support of more than 1,000 companies globally.

The TCFD’s recommendations are a good focal point for financial institutions because of the framework’s relative maturity, the degree of private sector input, and support of the official sector via the FSB membership, which is comprised of central banks, finance ministries, and global standard-setting bodies. We note that global banking and securities regulators will likely build upon this framework,6 particularly as individual jurisdictions gain experience through the supervisory process. Additionally, many of the largest financial institutions globally are leveraging the TCFD framework, which should meaningfully contribute to how disclosure frameworks continue to evolve as institutions and their investors discuss the new information and its impact.

Disclosure in Brief

Emerging standards such as the TCFD recommendations are useful frameworks to help organizations plan and develop their disclosure framework. The disclosure framework then needs to be shared with the front-line teams to ensure not only strategic alignment but that relevant data is captured by the teams most able to do so.

TCFD Recommended Disclosures

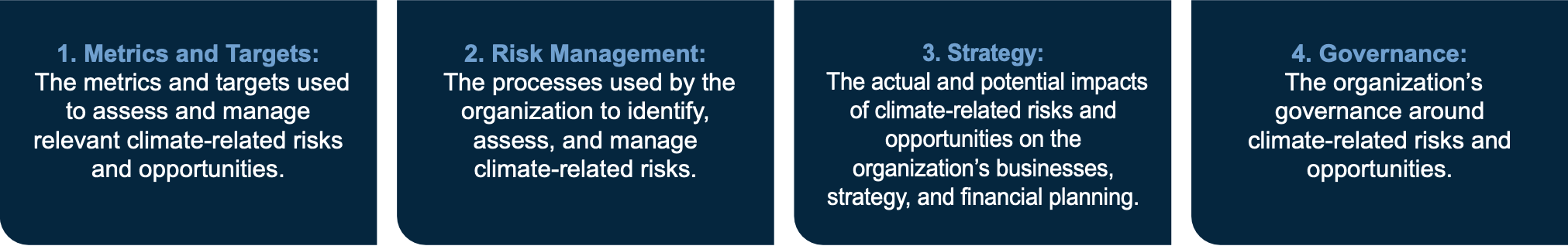

The TCFD recommendations consist of four core areas:

The Metrics and Targets recommendation provides guidance for defining and capturing the information necessary to understand an institution’s climate-related risks and their materiality. By creating clear and consistent metrics and definitions, the disclosures should empower investors, lenders, and insurance underwriters (which the TCFD refers to collectively as primary users) with the information necessary to assess and price climate-related risks and opportunities. Additionally, the TCFD framework will enable an institution to evaluate and compare climate-related risks and opportunities throughout its various business lines and operations. This includes evaluating climate-related impacts that are outside the traditional key performance indicators or prioritization frameworks that are used in the business units.7

The alignment around disclosure principles addresses how an institution communicates its risks and opportunities to external stakeholders. However, the disclosure framework should ultimately derive from the way an organization internally defines its goals and performance, which the TCFD underscored by identifying Metrics and Targets as a core disclosure area. What is notable in this case is that stakeholders are still defining the relevant data. The lack of finality in the data itself provides financial institutions with a unique opportunity to customize their disclosures in a way that best aligns with their unique corporate journey. The remainder of this Point of View will focus on how financial institutions can make this pivot from disclosing climate risks to creating a decision-making framework that supports a richer alignment between strategy, performance, and disclosure.

Deploying the Framework

One of the first challenges an organization faces in driving a new disclosure framework into the day-to-day business decisions is translating the data points to the front-line business teams. Most of these teams have their own well-understood performance metrics and targets that have previously served them well, but which do not capture nuances key to understanding climate-related financial risks. The front-line teams are an important resource in this process because they have direct line of sight into the business activities and impacts. Moreover, these teams have relevant experience that help to uncover unique insights into unintentional or indirect impacts outside of traditional financial metrics. For example, the front-line teams would be able to identify whether proceeds from a general line of credit are being used on weather resiliency or clean energy improvements to buildings or equipment.

Why might an organization invest time in reorganizing its front-line team’s metrics and targets? Climate-related disclosures, like any disclosure, must clearly and accurately communicate the impact of the operating unit whose activities are being reported – in this case, the impact of the unit on the environment and on key climate-related metrics. Moreover, climate risk does not exist in a vacuum – many organizations’ climate risk strategies are part of the firm’s broader sustainability program or a more holistic ESG strategy along with a corporate risk management strategy. The overlap of these activities with a new disclosure framework means that investors, regulators and supervisors, and the public at large have an interest in the accuracy and relevance of the information disclosed. It also means that financial institutions have a substantial reputational stake in meeting the needs of these stakeholders and articulating a complete picture of its value proposition.

Front-line business teams need to incorporate these strategies and related metrics and targets into their daily decision-making to execute on the organization’s goals. Doing this well requires that the relevant data are captured as early as possible in the relevant process. The complexity of aligning these various activities underscores the importance of ensuring that the metrics and targets are thoughtfully selected to serve multiple purposes.

Before undertaking this work, an institution must decide how to classify the data and analysis that it is expected to disclose. Helpfully, the TCFD has provided potential risks and opportunities, as well as useful examples for how they might manifest in practice. These examples are useful in planning how to deploy the metrics and associated data collection processes to the business units.

Additional Resources

While the TCFD puts the onus on the adopting institutions to develop specific metrics, the International Accounting Standards Board (IASB) and Financial Accounting Standards Board (FASB) have issued standards related to accounting for contingencies and asset impairments.8 These standards will be important going forward because future loan performance is an important risk related to climate change. However, they are beyond the scope of this piece.

Disclosing Risks & Opportunities – A Helpful Approach to Organizing

There are three widely recognized risk types that can be used to organize an institution’s climate-related financial risk disclosures. Additionally, the TCFD has provided a helpful approach to defining the opportunities that may arise because of the impacts of climate change. These outlines are helpful starting points.

Risk Types to Organize Climate-Related Financial Risk Disclosures

- Transition risk: Climate change manifesting in credit and market risk, as physical disasters and economic trends alter the long-term outlook for certain businesses, clients, and collateral. For example, consumer migration patterns impact a region’s economy, and thus the expected credit risk of borrowers living or operating in that region. The following are specific forms of transition risk:

- Policy risk

- Technology risk

- Market risk

- Reputational risk

- Physical risk: Disruptions related to physical disasters that likely, but may not always, result from climate change. For example, an operational resilience plan for physical locations or business systems would need to address flooding, severe weather, and other climate-related events. Physical risks are categorized as follows:

- Acute: Event-driven, including increased severity of regular disasters such as storms and weather.

- Chronic: Longer-term patterns in climate that might cause sea levels to rise or chronic heat waves.

- Liability risk: Arise from people or businesses seeking compensation for losses they may have suffered due to the transition or physical risks manifesting. The Bank of England provides a useful example of a business that incurs losses resulting from climate-related events potentially incurring liability to its investors related to the sufficiency of its disclosures.9

Opportunity Types Arising from Climate Change

Similarly, the TCFD identified five broad opportunity types that may arise from climate change:

- Resource Efficiency: By minimizing its climate impact, how can an organization create cost savings or new revenue streams as it minimizes its climate impact? An innovation may be in both categories e.g., building renovations, which are a capital expense for property owners while offering a new revenue stream for potential clients such as contractor.

- Energy Source: How would shifting to renewables impact annual energy spend?

- Products and Services: What can the organization create to enable a cleaner future or help others adapt to expected climate changes? For instance, can the institution create alternatives to the National Flood Insurance Program or personal finance products to help mitigate damage caused by severe weather?

- Markets: How would systemic impacts lead to the development of entirely new markets?

- Resilience: How does an organization’s strategy hold up in the event of a severe disruption, such as extreme weather or the failure of a large client? What framework or process guides the organization’s adaption once the disruption occurs?

A set of examples to consider can be found on page 10 of the TCFD recommendation.10

Measuring Financial Impact

Once an institution has its disclosure framework outlined, it must identify the data to disclose. Put another way, the institution must connect the external disclosure framework to the existing business activities and impact metrics and resolve gaps or conflicts between the two. This resolution process will determine how effectively the new metrics and targets are able to guide future business decisions and how well those decisions further the financial institution’s overall strategy.

- Balance Sheet

- Assets and Liabilities: Supply and demand shifts from changes in policies, technology, and market dynamics related to climate change could affect the valuation of an organization’s assets and liabilities. This will vary with the expected life of a particular asset or capital reserve.

- Capital and Financing: Climate-related risks and opportunities may change the profile of an organization's debt and equity structure.

- Income Statement

- Revenues: The firm should carefully assess the impact of climate-related risks on its revenues and identify potential opportunities for enhancing or developing new revenues.

- Expenditures: An organization’s response to climate-related risks and opportunities may depend, in part, on the organization’s cost structure.

Getting Started

Quick Tips for Getting Started

So how does an institution start?

Step 1: The institution should carefully define its business lines, products, and activities.

Step 2: Next, the institution should classify how those operations intentionally or unintentionally impact the climate, customers, and other stakeholders.

Step 3: Similarly, it should classify the impact of its various corporate teams, such as communications, investor relations, community engagement/investment, centralized finance, procurement, or transformation teams.11 In doing so, it is imperative to choose an organizing methodology to allow comparison across operating units. This will allow institutions to efficiently aggregate like with like and find opportunities for cross-pollination without losing key nuances within individual units. For instance, an institution can organize around similar KPIs, operating models, supply chains, and accounting or financial statement impact.

Questions to Define Risks & Introduce Opportunities

Some helpful questions that help define risks as well as introduce opportunities include:

- What is the firm’s high-level climate risk strategy with respect to transitioning away from or towards particular asset or exposure types?

- How reliant are the business units or products on climate-sensitive expenses such as travel or flood insurance costs?

- Is the performance of a branch or team heavily dependent on a carbon-intense activity? Is a borrower reliant on a supply chain that might experience disruption from a climate disaster?

- For each potential trigger or impact, how can the organization react across its operating units to profit or mitigate losses? For example, can it compensate for the impact of higher flood insurance costs on home prices with commercial loans (for instance, to remodelers or resiliency businesses) or increased sales efforts in other locations?

- Is there a risk-sharing market that can allow an institution to shed exposure, either individually or in bulk?

This process consists of an iterative dialogue between the board and senior management as well as among the strategy, investor relations, accounting, and business units. This process should be embraced. Ongoing, iterative dialogue will allow managers and their front-line teams to contribute over time, providing context for the institution’s framework and identifying practical insights that will unlock new approaches or strategies. Once the organization has its data, performance, and disclosure frameworks aligned, leaders will be able to set priorities and empower their teams to further the strategy with minimal micromanagement or friction. It is helpful to remember that there is a reason TCFD recommended that different industries focus on different areas of its recommendation. Ultimately, while the disclosure framework is intended to cover a common global risk, industries and businesses have different ways of creating value. Institutions should take advantage of the opportunity to develop the criteria by which they communicate performance and unlock value.

Conclusion

Dynamic strategic planning is critical for all organizations to help ensure successful performance especially during times of uncertainty and change. The strategic plan lays out the vision for the organization and has taken on increased importance in consideration of climate change. There is now a greater demand among investors and other stakeholders to better understand how climate related issues affect an organization’s strategic direction. Meeting this demand begins with creating a framework that clearly discloses the risks and opportunities the organization faces as a result of climate change. The absence of a globally accepted disclosure standard gives financial institutions a unique opportunity to connect their strategic planning more directly to the communities they serve and the business decisions they face day-to-day. Taking advantage of this opportunity requires a feedback loop between the disclosure framework and the criteria by which first-line business decisions are made.

Boards and leaders of financial institutions should assess their current disclosures and performance criteria across business lines, products, and activities. Next, they should facilitate a review of the intentional and unintentional impacts of those activities. The goal should be twofold: (1) to uncover gaps and conflicts between the new data and old and (2) discover intersections between activities t hat could create new opportunities or mitigation strategies.

Lastly, once the organization has a clear picture of its activities and impacts, it should evaluate them against its business plan and strategy. It should then revise and implement its plan and strategy accordingly, using the new metrics and targets it has set to support the front-line business teams. This should be approached as a change management effort to underscore the organization-wide alignment that will take place and the importance of the desired impact on customers, investors, and stakeholders.

References

- Executive Order on Climate-Related Financial Risk | The White House

- SEC.gov | Public Input Welcomed on Climate Change Disclosures

- Bank of England publishes the key elements of the 2021 Biennial Exploratory Scenario: Financial risks from climate change | Bank of England

- BlackRock calls for climate change disclosure, expects sustainable investing to continue (cnbc.com)

- Recommendations | Task Force on Climate-Related Financial Disclosures (fsb-tcfd.org)

- Consultation Paper on Sustainability Reporting (ifrs.org)

- For instance, tracking greenhouse gas emissions related to physical expansion as a discrete component of overhead costs.

- IFRS - IAS 37 Provisions, Contingent Liabilities and Contingent Assets; Microsoft Word - Proposed ASU Contingencies _Topic 450_ Disclosure of Certain Loss Contingencies.doc (fasb.org)

- Climate change: what are the risks to financial stability? | Bank of England

- FINAL-2017-TCFD-Report-11052018.pdf (bbhub.io)

- ESG rating agencies such as Thomson Reuters ESG Scores, Corporate Knights Global 100, and Sustainalytics ESG Risk Ratings are helpful resources here for providing context.

Table of Contents

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.